How PLAZA Works

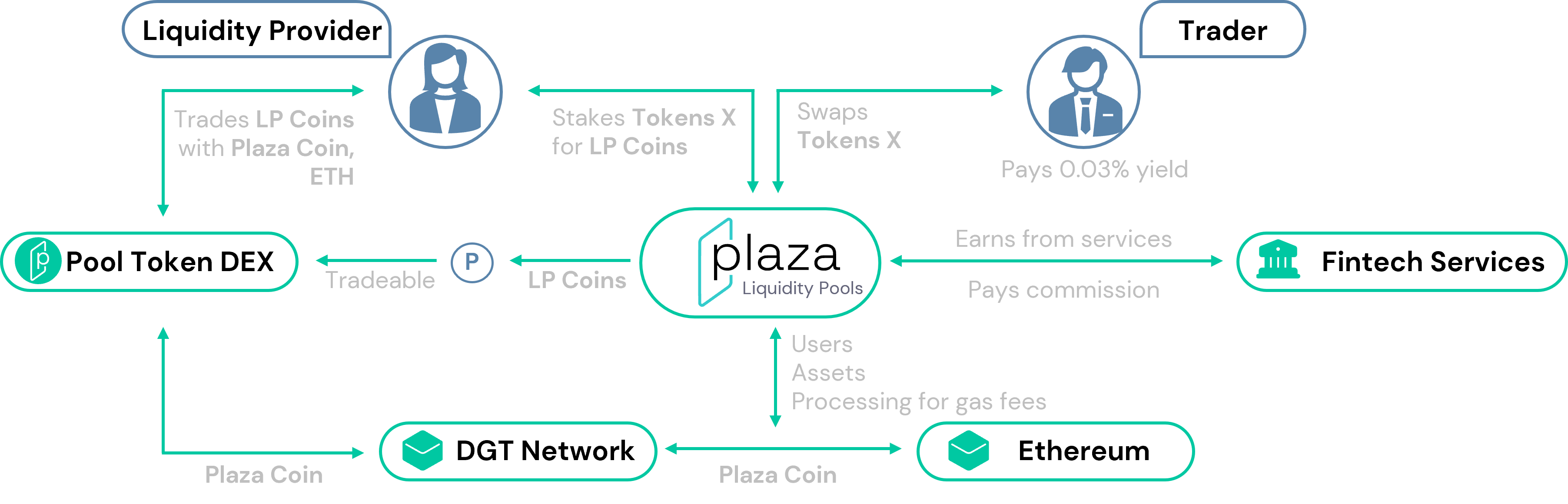

PLAZA is a special type of trading platform, like a digital marketplace, where people can buy and sell digital money, such as Ethereum (ETH) and a stablecoin called USDT. Unlike regular markets, PLAZA doesn’t need a big bank or company in the middle to make trades happen. Instead, it uses technology that lets people trade directly with each other. This makes trading faster and usually cheaper because there are fewer fees.

PLAZA uses two different systems working together to make everything run smoothly. One part is DGT, which is fast and keeps the costs low, and the other part is Ethereum, which is super secure. When you trade on PLAZA, it’s like using a shortcut for faster results but still having the safety of a main road. This setup helps make trading safer, quicker, and easier, even for people who are new to digital money.

In the future, PLAZA will also let people trade “real-world” things, like pieces of real estate or company stocks, but in a digital form. For now, it focuses on making sure trading ETH and USDT is easy and reliable, bringing in a lot of different people, from beginners to big companies, who want a simple, dependable place to trade digital assets.

Read More

PLAZA is designed not only to provide a seamless trading experience today but also to pave the way for future growth and feature expansion

PLAZA leverages artificial intelligence (AI) and automated processes to simplify compliance—a key factor for institutional and retail users alike. AI algorithms monitor transaction patterns to identify and flag unusual activity, while DGT’s off-chain notary nodes verify transactions quickly and securely. These notaries handle compliance checks without slowing down the platform, giving users a safe and efficient trading experience.

PLAZA is designed with the future of finance in mind, including the integration of tokenized real-world assets (RWAs). By tokenizing assets like real estate, commodities, and stocks, PLAZA can offer users a way to trade beyond cryptocurrencies alone. This feature appeals to a wide range of users, from crypto traders to traditional investors, as it creates new opportunities for portfolio diversification and access to traditionally illiquid assets.

Privacy is essential, particularly for institutional clients who may require higher con-fidentiality standards. PLAZA’s shielded transaction feature uses advanced cryptography to hide sensitive transaction details, such as the identity of buyers and sellers and the amounts exchanged. While standard blockchain transactions are transparent, shielded transactions offer a level of privacy that attracts users concerned about data security.

PLAZA encourages user engagement and platform liquidity through yield farming and staking. In yield farming, users provide liquidity to trading pools in exchange for rewards, making it easier for others to trade without delays. Staking allows users to earn additional tokens by locking up their assets, which strengthens the DGT token economy and provides a stable foundation for growth.

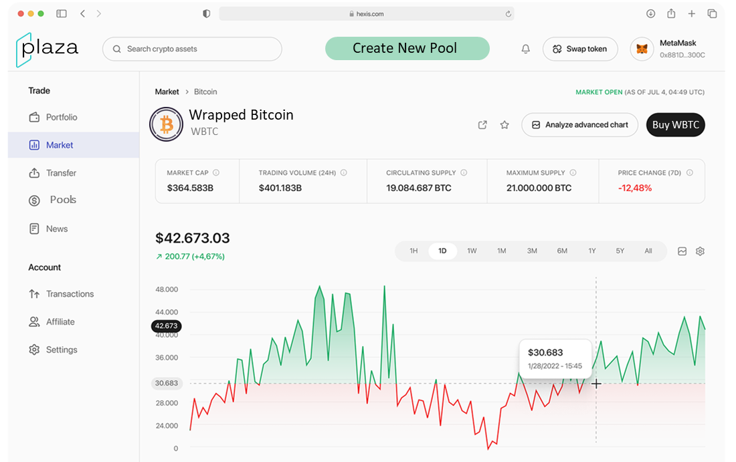

At the heart of PLAZA’s trading mechanism are decentralized liquidity pools, where users deposit assets to enable quick and efficient trading. These pools reduce dependency on traditional order books, instead using Automated Market Maker (AMM) algorithms to fa-cilitate trades directly between users.

PLAZA’s cross-chain bridge to Ethereum allows assets to move securely between DGT and Ethereum networks. This bridge contract locks tokens on Ethereum, creating corresponding assets on DGT, which enables a hybrid approach where users enjoy the speed and affordability of DGT with the security of Ethereum.